The Intelligent Financial Fabric of Everyday Life

Powering trusted payments, personalized money guidance, and context-aware value creation for people and businesses across emerging markets.

Bancify connects payments, data, and embedded financial services into a single intelligent platform — designed to make every transaction seamless, every decision smarter, and every business more prosperous. Whether you’re a fintech, a bank, or an individual user, Bancify is the invisible engine behind your modern financial experience.

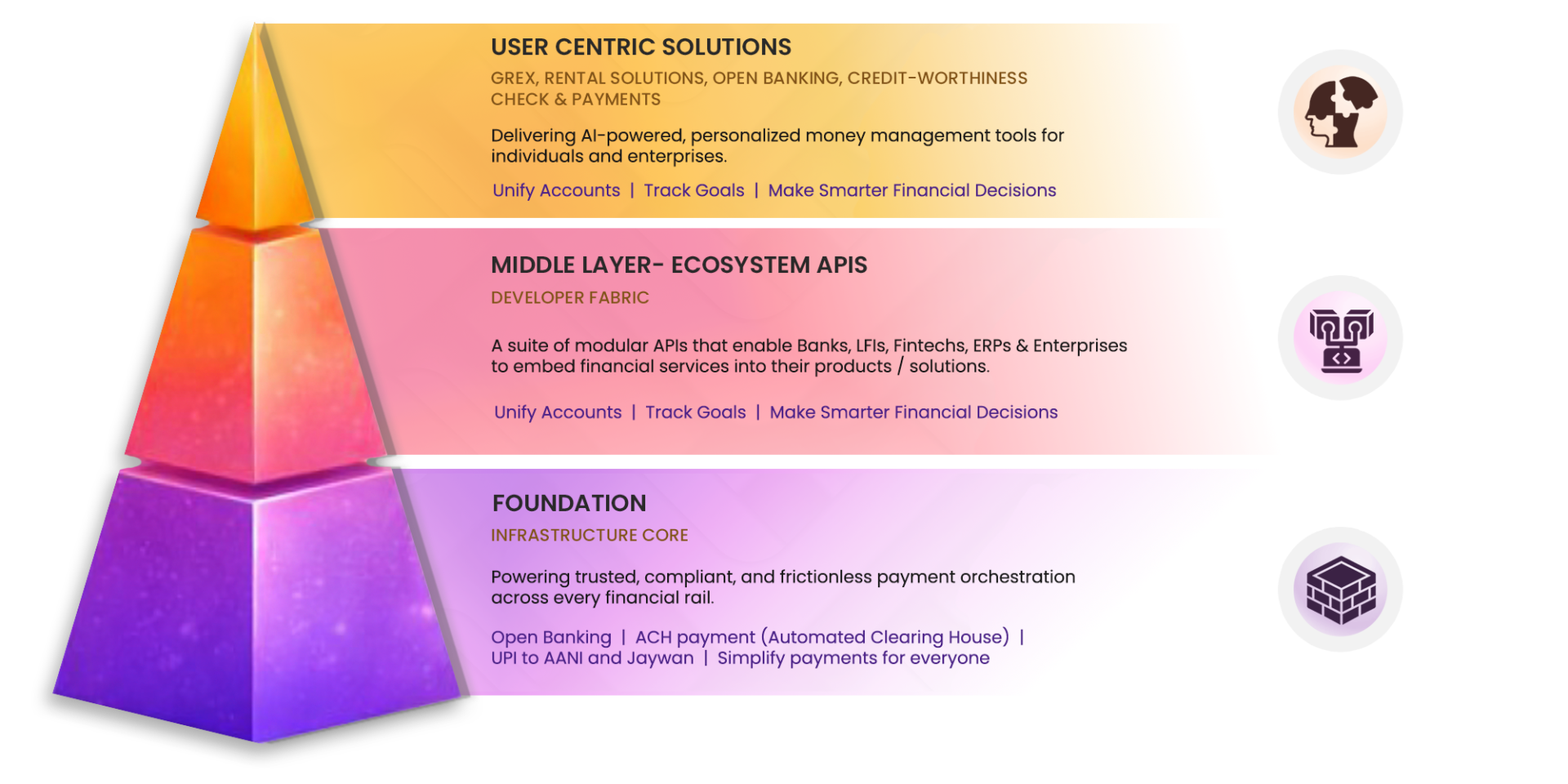

The Bancify Ecosystem

One Platform. Infinite Possibilities.

Bancify brings together powerful product pillars — each designed to simplify and enrich how individuals and businesses handle money, liquidity, and financial intelligence.

User Centric Solutions

GREX, Rental Solutions, Open Banking, Credit-worthiness check & Payments

Delivering AI-powered, personalized money management tools for individuals and enterprises.

- Unify Accounts

- Track Goals

- Make Smarter Financial Decisions

Middle Layer- Ecosystem APIs

(Developer Fabric)

A suite of modular APIs that enable Banks, LFIs, Fintechs, ERPs & Enterprises to embed financial services into their products / solutions.

- Unify Accounts

- Track Goals

- Make Smarter Financial Decisions

Foundation

(Infrastructure Core)

Powering trusted, compliant, and frictionless payment orchestration across every financial rail.

- Open Banking

- ACH payment (Automated Clearing House)

- UPI to AANI and Jaywan

- Simplify payments for everyone

Transform your invoices into working capital — fast

Our Product Suite

Unified Solutions for a Connected Financial World

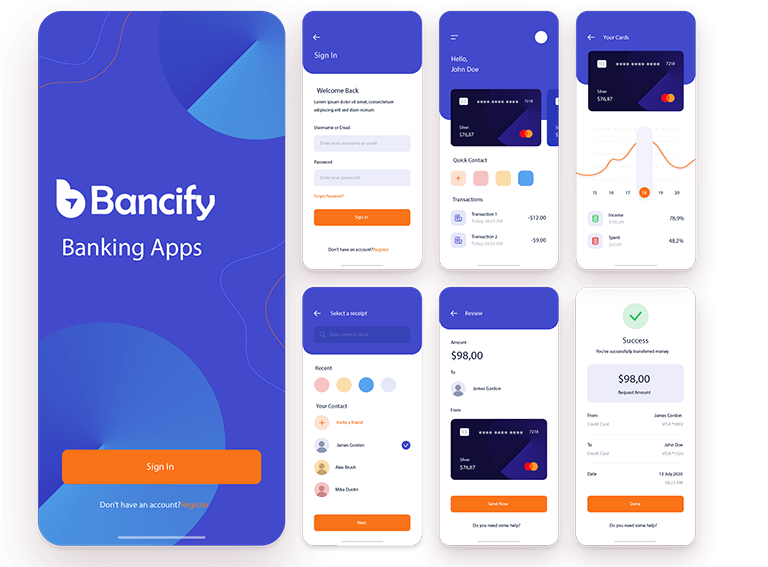

Savvy App

FinAxis Web App

Open Finance APIs

Developer-first financial rails and integrations which enables ERPs, other enterprises and financial institutions to quickly be part of the open banking ecosystem by utilizing the “embedded banking” modules.

Rental Payment Solution

Reimagining the Rental management automation clubbed with standing instructions and recurring payments for large entities, smaller entities and individuals is another prominent offering from us. This will give real time status updates, notifications, reminders and smoothen the operations activites.

GREX Solution

Receivables and liquidity marketplace for SMEs. Unlocks cash flow and accelerates business growth.

NACH Solutions

Unified payments & recurring collections infrastructure for Banks, NBFCs, Insurance providers, OTT & SaaS solution providers for payment automation and intelligent business decisions. Our NACH solution is secure, reliable, simple, regulated and locally optimised.

Fignite

Independent & AI powered credit worthiness assessment & early default warning platform for LFIs, NBFCs to get deeper insight of customer’s financial health, FOIR, spending habits etc. This enables the underwriter to assess the risk thoroughly before any approvals.

More About Bancify

Built for Emerging Economies. Designed for the Future of Finance.

Bancify is building inclusive, intelligent, and trusted financial infrastructure for the new digital economy. Our platform unifies multiple financial rails — from UPI, AANI, and Jaiwan to wallets, cards, and open banking APIs — into one orchestration layer that powers seamless transactions across India, GCC, and Southeast Asia.

With AI-driven personalization, a compliance-first approach, and deep regional localization, Bancify redefines how individuals and enterprises interact with money — making finance smarter, simpler, and more human.

Years of Experience

Satisfied Clients

Why Bancify

Beyond Transactions. Toward Prosperity.

Bancify isn’t just another fintech infrastructure — it’s a humanized layer of financial intelligence. Our AI understands context, predicts behavior, and guides users and businesses toward clarity and growth. By combining payments, insights, and liquidity into one adaptive ecosystem, Bancify enables every partner to prosper — without noise, friction, or risk.

Three Key Differentiators:

AI That Feels Human:

Explainable and empathetic — guiding every financial action intuitively.

Localization at Scale:

Compliant, adaptive, and regulation-ready across emerging markets.

Two-Sided Growth Loop:

Individuals and enterprises engage through a shared ecosystem — driving retention and revenue growth.

Who We Serve

Empowering Every Financial Journey

Bancify bridges the gap between Banks, individuals, enterprises and financial institutions — creating a truly inclusive financial ecosystem.

Individuals

Simplify money management with real-time insights, goals, and alerts.

Businesses

Automate collections, invoice discounting, streamline payouts and manage cashflow intelligently.

Fintechs & Developers

Build fast with our modular APIs, SDKs, and developer sandbox.

Banks & LFIs

Integrate with open banking frameworks, credit-worthiness checks and unlock next-gen customer experiences.

Testimonials

Trusted by Innovators.

Recognized by Industry Leaders.

From leading banks to next-generation fintechs, our partners trust Bancify to power their most critical financial operations. Explore how Bancify is shaping the evolution of open finance and embedded intelligence across emerging economies.

- Partner, Leading GCC Bank

“Bancify’s orchestration engine brings the intelligence we always wanted in our payments stack — adaptive, compliant, and deeply local.”

Built for Trust & Compliance

Compliance-First by Design. Trusted Across Regions.

Bancify embeds compliance and regulatory frameworks directly into its workflows — making transparency and security a core feature, not an afterthought. From RBI and NPCI to GCC’s Open Banking and UAE’s AANI, our infrastructure is aligned with every major directive.